“It’s time for a serious discussion about nationalizing fossil fuel companies to shut them down.” declared @climateboomer on Twitter/X. Lawrence MacDonald aka @climateboomer was responding to a tweet from Jamie Henn, director of Fossil Free Media and co-founder of Bill McKibben’s 350.org. Henn was leveraging news about the weather (a heatwave in this case) to beat the climate austerity drum—an all-too-familiar tactic these days.

Railing against fossil fuels is nothing new, but this was the first time I had heard of this concept: Nationalizing the fossil fuel industry in order to shut it down.

I had to ask myself: is Climate Boomer just being a weird boomer? Or are other people actually suggesting this radical agenda?

As it turns out, only a few days prior, Green Party Presidential Candidate Cornel West issued a press release calling for “the nationalization of the fossil fuel industry and an immediate halt to oil, gas and coal extraction to combat the climate emergency.”

West said the climate emergency, which requires a “swift and radical” response, is one of the major reasons for his campaign..

“On my first day in office I will use the National Emergencies Act, the Defense Production Act, and the Stafford Disaster Relief and Emergency Assistance Act to order an immediate cessation of all oil and gas leasing projects on federal lands and waters,” West said. “I will impose a ban on the poisonous practice of fracking. I will demand an immediate moratorium on liquefied natural gas facilities. I will cancel proposed fossil fuel projects including Joe Manchin’s Mountain Valley Pipeline and Joe Biden’s Willow Project.

The campaign to nationalize fossil fuel in order to shut it down goes further back than the current year of 2023. In 2020 Kate Aronoff wrote for The New Republic A Moderate Proposal: Nationalize the Fossil Fuel Industry. Aronoff presents a picture of national crisis around energy and climate. Her proposed solution points to the work of a think tank called Democracy Collaborative:

The Democracy Collaborative’s Carla Skandier, on the other hand, has suggested a “51 Percent Solution for the Climate Crisis,” in which the government takes a majority stake in privately owned fossil fuel firms, winding down production along a science-based timeline and giving workers a dignified off-ramp into other well-paid work, all the while muting the industry’s enormous influence over our political system.

A year earlier, Jacobin published a very similar piece, with a much bolder headline: Democratize Finance, Euthanize the Fossil Fuel Industry. This one was written directly by researchers for the same think tank. Research associate Johanna Bozuwa and research director Thomas M. Hanna at the Democracy Collaborative write:

The explicit goal would be to use public ownership to plan the sector for obsolescence: stopping all new exploration, closing shop before already-in-use reserves were fully exploited, and eliminating fossil fuel exports from the US. The phaseout would include a series of programs and investments that ensured a just transition for workers and communities that currently rely on fossil fuel extraction.

The Jacobin article adds more devilish details about how exactly this overarching plan will unfold: banking.

In addition, a publicly owned Green Investment Bank (or banks) could be established — perhaps by nationalizing an existing Wall Street bank and converting it — and fossil fuel company investors, especially public and worker pension funds, could be incentivized to roll over their investments to its bonds. The Green Investment Bank would play an integral role in making the substantial investments in renewable energy that would accompany the fossil fuel company drawdown in order to maintain an adequate supply of energy to meet demand.

All of these pieces lead up the ladder to what seems to be a critical institution in this agenda.

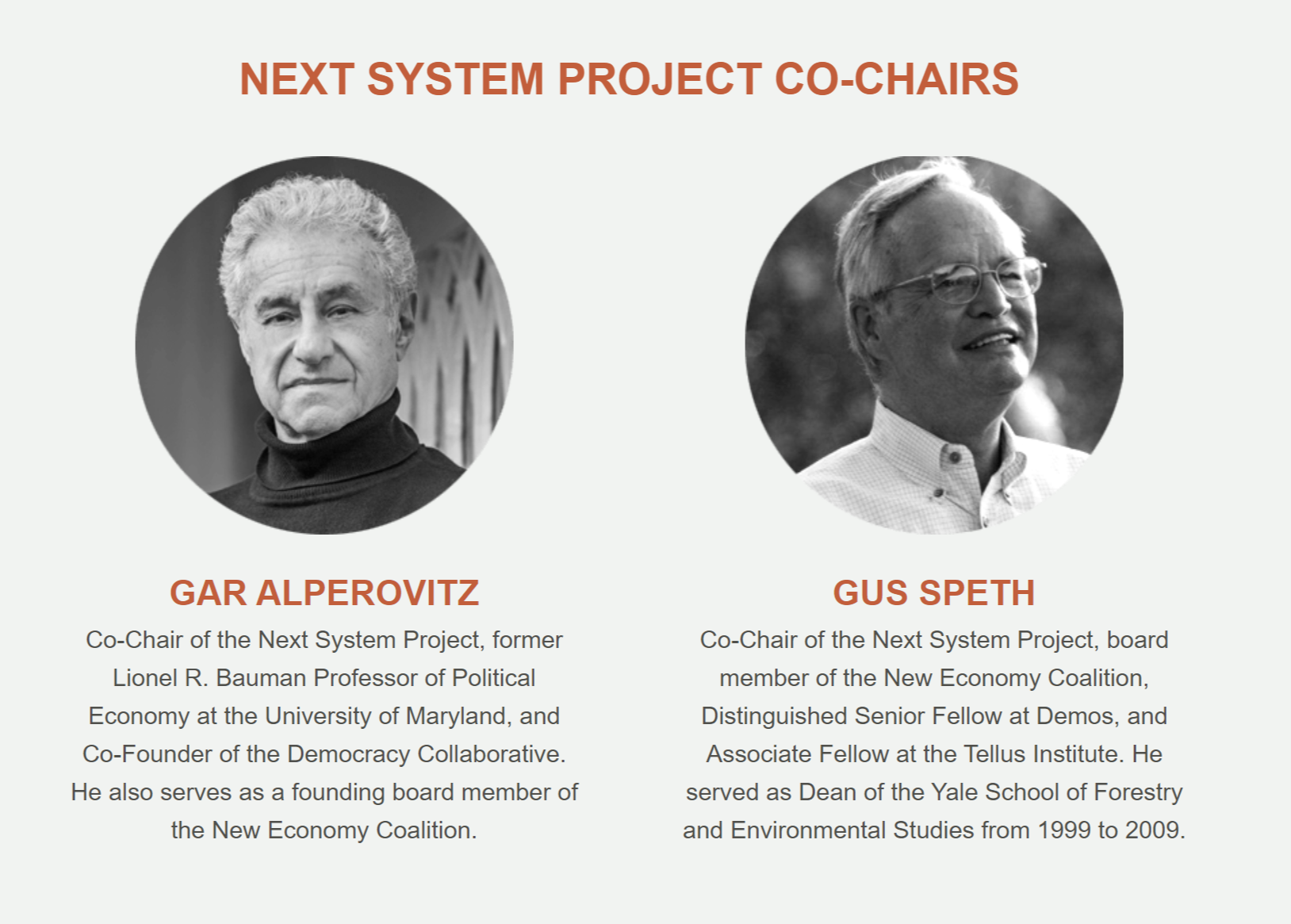

Democracy Collaborative

In 2000 economist Gar Alperovitz co-founded The Democracy Collaborative which purports to focus on “community wealth building and environmental and social sustainability.” One of the major projects of Democracy Collaborative is called The Next System Project, which is co-chaired by Alperovitz and environmental lawyer James Gustave (Gus) Speth. Gus Speth is co-founder of the Natural Resources Defense Council (NRDC), an aggressively litigious advocacy organization, notorious for using legal action as its primary tool to push its environmental agenda, leading to excessive regulation and hindering economic development.

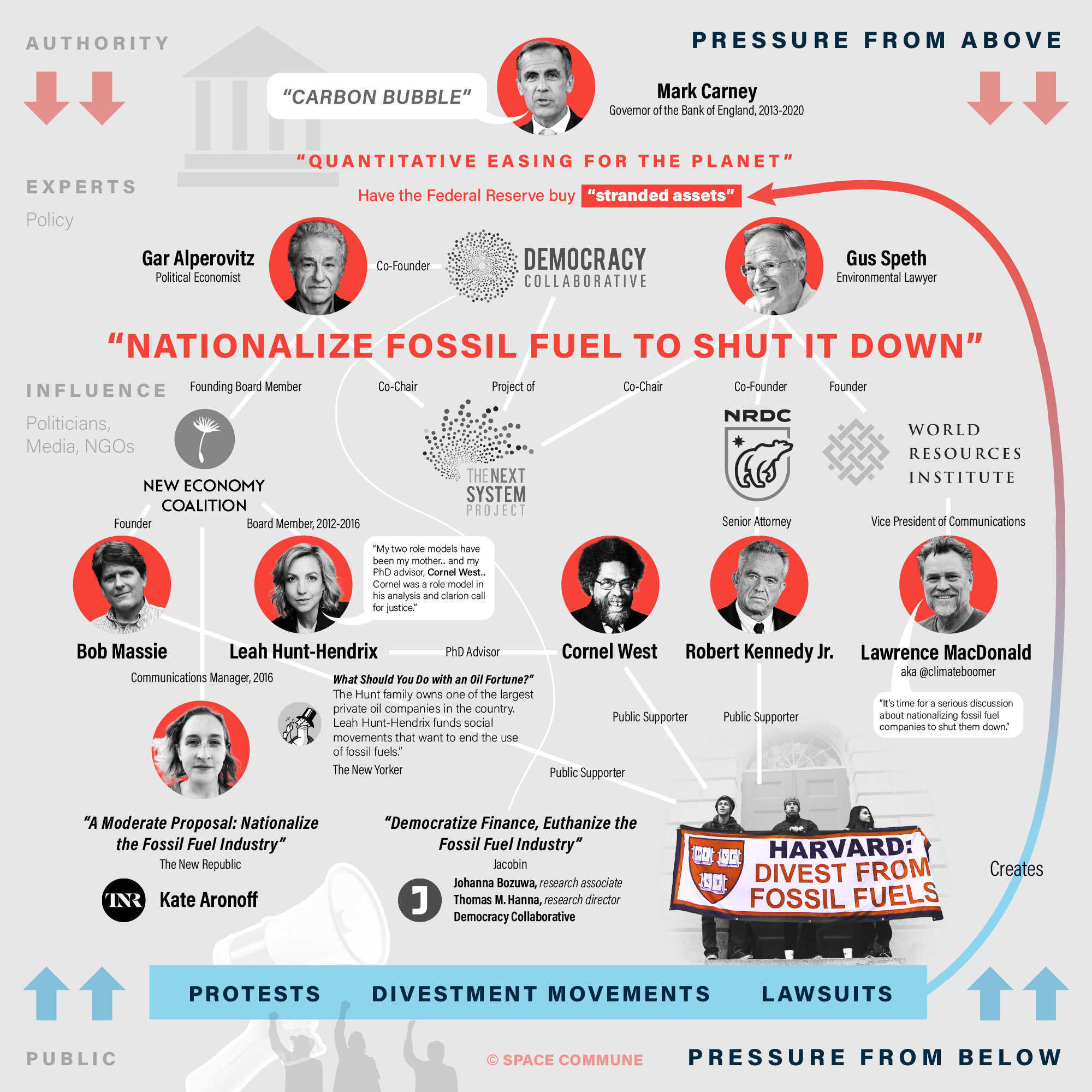

All arrows are pointing to this think tank, Democracy Collaborative, and this project, The Next Systems Project (NSP) as the progenitor of the “Nationalize Fossil Fuel to Shut it Down” agenda. Aronoff’s article, mentioned earlier, links to a piece written by NSP’s Carla Skandier titled Quantitative Easing for the Planet.

Quantitative Easing For the Planet

The 2018 plan outlined by Skandier for Democracy Collaborative is as follows (emphasis my own):

1: Set precedent by invoking the 2008 financial crisis. The housing finance industry was federally bailed out then, why not use this “proven” tactic now?

Without the political spine to implement even simpler market-based mechanisms, how will government ever be energized to take over fossil fuel companies? Quite simply, it might have no other option. Many fear that the fossil fuel sector could be instigating the next financial crisis. In 2008, the US economy neared collapse when the mortgage market was overestimated.

2: Create an analogy to the fossil fuel industry. Skandier cites regulations, divestment movements and protests as an indicator of a future with less fossil fuel.

The same peril is mounting again, but this time in the shape of fossil fuel reserves and infrastructure that will no longer be needed—and so won’t provide the expected financial returns. Fear of stranding assets in this way has grown among financial regulators and investors. As nations committed to limiting temperature increases to “well-below 2°C above pre-industrial levels and pursu[ing] efforts to limit the temperature increase to 1.5°C above pre-industrial levels,” environmental regulations across the world have since tightened and civil society has started to revoke some of these organizations’ social license through growing lawsuits, divestment movements, and protests. If these actions succeed even partially, reserves and supply infrastructures will be retired “prematurely,” stranding vast fossil fuel assets and inviting market chaos.

Estimates around the size of the fossil fuel threat in the global financial market vary widely. The highest number so far, presented by CitiGroup in 2015, is US$100 trillion—significantly more than the total losses from the 2008 financial crisis. Mirroring the previous crisis, both the responsible sector and millions of workers and companies outside the fossil fuel market would feel the pain. Bank of England’s (BoE) Governor Mark Carney contends that up to one-third of global wealth may be at risk due to fossil fuel stranded assets, including that of pension funds that hold the retirement of teachers, veterans, and nurses.

3: Prevent another financial crash by offering a federal buyout of the industry.

The proposal’s true game-changer, however, is making climate action attractive to fossil fuel companies facing endless negotiation and litigation. As an alternative to “produce all now or lose most later” (catchwords often used to tar climate policies), a federal buyout affords a reasonable exit option to fossil fuel companies by giving investors a return without having to keep up production. Given the future prospects of fossil fuel companies’ stocks, investors might even take legal action on the basis of a breach of fiduciary duty if managers refuse to sell their companies for a fair enterprise value. This open door is a key way out of our current roadblock and a way to bring investors and companies on board sooner rather than later.

If we zoom out and look at what’s really going on with this plan, we can see that it is controlled at both ends, top and bottom. Crisis is created via regulation, divestment movements and protests. Economic pressure is put on the industry: if the future has no fossil fuel, those with financial stake in the company are coerced to cut their losses, at which point the federal government can step in and buy them out.

Top down and bottom up

The various characters already mentioned have all played a part in creating the bottom-up pressure identified by Skandier: lawsuits, divestment movements and protests. Here are just a few (of the many) within the same network that have participated in promulgating the “nationalize fossil fuel to shut it down” initiative over the past decade and beyond:

Natural Resources Defense Council

As mentioned before, NRDC co-founded by NSP co-chair Gus Speth has been a major player in environmental legislation, boasting how they’ve been “suing polluters since 1970.”

Notable people and their connections:

Gus Speth, environmental lawyer, Co-Chair of The Next System Project

Presidential candidate Robert Kennedy Jr., Senior Attorney for NRDC

Harvard Fossil Fuel Divestment Movement

A movement founded in 2012 by students linked to Bill McKibben (who is also a Harvard alum) who put pressure on Harvard to divest from fossil fuel-related investments and raise the profile of anti-fossil fuel activism in general. By 2015 the movement was netting major press and celebrity endorsement.

Some of Harvard’s most prominent graduates – from Hollywood star Natalie Portman to environmentalist Robert Kennedy Jr and the scholar Cornel West – called on the world’s richest university to dump fossil- fuel companies from its $36bn endowment.

Notable people and their connections:

Presidential candidates Cornel West and Robert Kennedy Jr. were both vocal supporters

Robert (Bob) Massie, public supporter and Founder of New Economy Coalition

New Economy Coalition

The New Economy Coalition was also founded in 2012.

It began as a think tank, modeled after the New Economics Foundation in the UK, based on the framework of “new economics” popularized by leaders at what had previously been the E.F. Schumacher Society in Western Massachusetts.1

Notable people and their connections:

Bob Massie, Founder

Leah Hunt-Hendrix, Board Member from 2012-2016, Oil Fortune Heiress who considers her PhD advisor, Cornel West a role model

Kate Aronoff, Communications Manager, 2016, Journalist for The New Republic

World Resources Institute

World Resources Institute was founded by Gus Speth in 1982 with a $15 million grant from the John D. and Catherine T. MacArthur Foundation.2 It’s a massive organization that receives around $200 million in grants annually from leftist foundations such as Rockefeller, Gates and Open Society and The World Bank. In 2018 they hosted an award ceremony honoring two activists for blocking a deal South Africa made with Russia to develop 9.6 gigawatts of nuclear energy by building eight to ten nuclear power stations throughout South Africa.3

Notable people and their connections:

Founded by Gus Speth

Lawrence MacDonald aka Climate Boomer, Vice President of Communications at World Resources Institute

These are just a few notable people within a much larger network. It’s vitally important to communicate how tightly knit this network is despite no obvious unified outward appearance. The role these people play is to cast a wide net over public opinion and create the illusion of a large, decentralized and democratic point of view for a policy that is actually extremely damaging to the wellbeing of the world’s population.

Word from On High: The 1.5°Celsius Society

We could spend many hours, days even, uncovering all of the voices meant to apply pressure from below – the ones tasked with “manufacturing consent.” But we’d be fools to ignore the more singular messaging being received from on high. In Skandier’s paper, she refers, quite eerily, to aligning with the goal of a 1.5° Celsius society.

Shortening the renewable-energy investment gap, a federal takeover would also send a clear signal that the future is renewable, channeling investors’ decisions away from fossil fuels and toward projects aligned with the goals of a 1.5° Celsius society.

What the heck is a 1.5° Celsius society and who is signing me up for it without my consent? How can a specific temperature degree represent the final metric and pinnacle of human achievement? Why is a specific degree what we are striving for and what is dictating our entire existence as an international community?

Clearly this arbitrary data point is pure dogma, and has nothing to do with human flourishing. But no one within this network can question it, in fact it is the backbone of all policy created and disseminated in the name of “euthanizing the fossil fuel industry.”

Mark Carney, the [Financial Stability Board] chair stated that a carbon budget consistent with a 2°C target “would render the vast majority of reserves ‘stranded’ — oil, gas and coal that will be literally unburnable without expensive carbon capture technology, which itself alters fossil fuel economics”.4

Mark Carney served as the governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. He is the Chair of Bloomberg Inc. He is one of the most powerful bankers in the world. It is from people like Carney that the unquestionable dogma of the 1.5° Celsius society originates, and which is why we must therefore prepare for the fossil fuel financial crisis created by “stranded assets” – assets that will require a Federal bailout and effective “nationalization” if “growing lawsuits, divestment movements, and protests succeed.” International bankers set the dogma from above; the network of think tanks, NGOs, lawyers, journalists and activists work in lockstep to create consent from below.

Is nationalizing industry bad or good?

Has there ever, in the history of civilization, been a time when society nationalized an industry with the specific purpose of shutting it down? The answer is no.

In Cornel West’s press release mentioned earlier, he invokes the The Defense Production Act (DPA). DPA is a United States federal law that grants the President the authority to direct domestic industries to prioritize and increase the production of essential goods and materials during times of national emergency, including during war, natural disasters, or public health crises. This is why Green politicos are always calling to declare a “climate emergency.”

The DPA has, in fact, been invoked in recent years by politicians. In 2018 President Trump invoked the DPA in an attempt to save American coal and nuclear plants from being shut down. This is the exact opposite reason Cornel West wants to leverage the act. West wants to shut down fossil fuel; Trump wants to keep it open.

This brings us back to the beginning. Nationalizing fossil fuel in order to shut it down? That sounds insane to me. Because it is insane. Nationalizing an industry to keep it going for the good of the national economy and working people is an objectively good thing. And it’s something that we almost certainly will have to do to some degree if we want to continue having a robust civilian nuclear energy fleet.

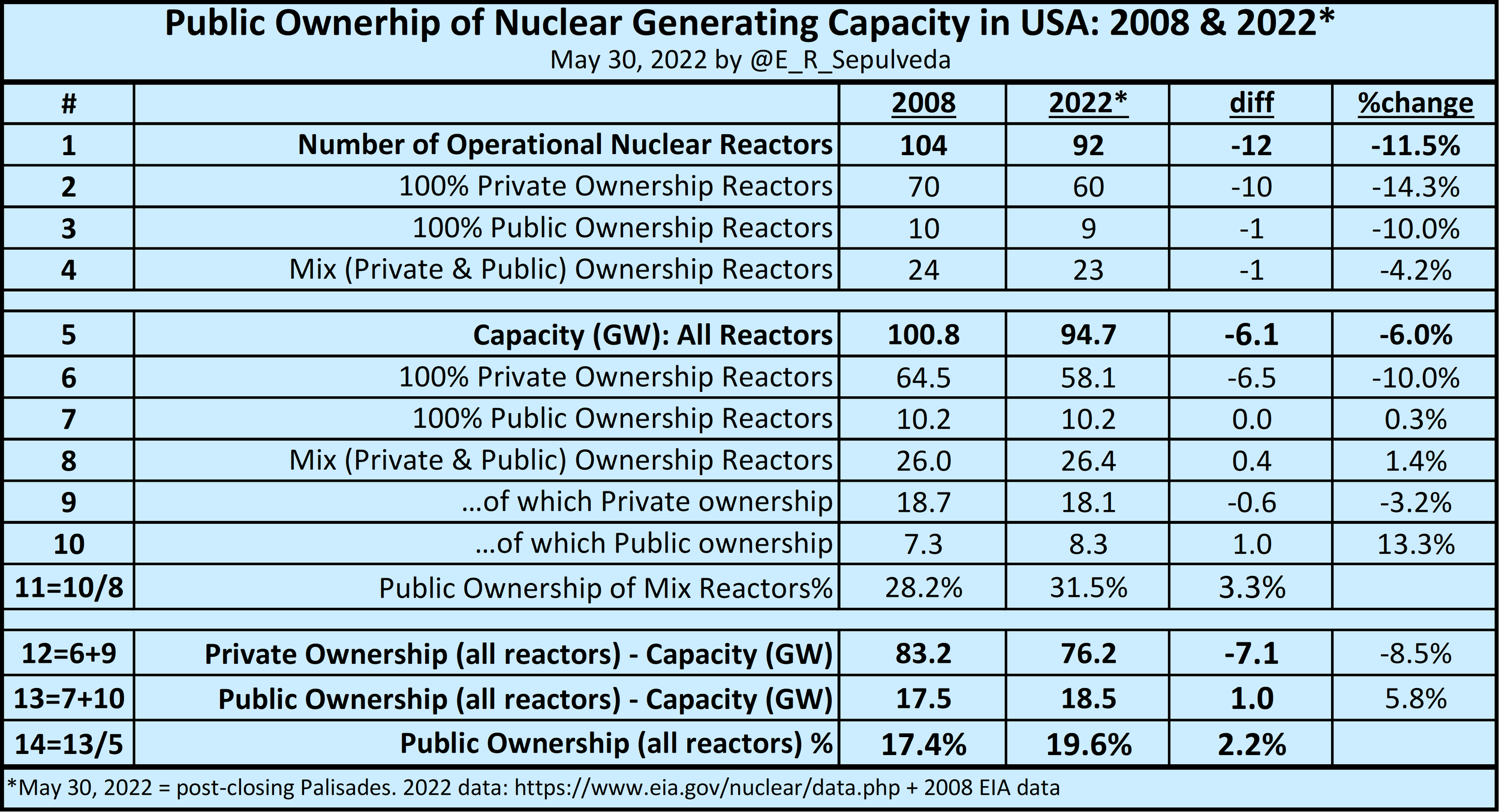

A recent study by independent consulting economist Edgardo Sepulveda about publicly-owned nuclear energy found that, overwhelmingly, publicly owned plants stayed open while private ones tended to shut down. Sepulveda concludes that:

… it could be the case that a partial purchase in a 100% privately-owned reactor, or an increase in the ownership share of a mixed-ownership reactor, by a public entity, could reduce the chances of that reactor closing in the future.

Nationalization, or public ownership of productive resources is being touted by the left coupled with a bizarre message of “shutting it down” in the process. It’s actually a major scandal that the American people are left to believe that the one thing that might save our national productive capacity— and with it our jobs, wealth and prosperity—will be used as a threat by international bankers and civil society working in tandem to create a dystopian 1.5°C Society that no one actually wants. We should be nationalizing our energy sectors in an effort to prevent them from closure, not with the intent to do so ourselves.